"MANY years of my life had been devoted to speculation

before it dawned upon me that nothing new was happening in the

stock market, that price movements were simply being repeated, that while

there was variation in different stocks the general price pattern was the same...."

- Jesse Livermore

Livermore Market Key Table. (Click to enlarge)

In his book, "

How To Trade In Stock"(<-downloadable), the stock speculation king,

Jesse Livermore had spent a great deal of effort to illustrate how he used his own method in determining the trend of stocks... And he named it as the "Livermore Market Key".

Although the method was published in 1940, and many traders who had read some classical trading book must have come across this Tool, this method is not popular at all. I guess, most likely, that it involves with lot of manual work in updating the table as shown above. With current technology, this can be programmed into charting format to make it more user friendly as the following chats...

In the Market Key System, Livermore applies two level of filter to double check whether the stock is in Up-Trend or Down-Trend. So at anytime, a stock is classified into one of the six states:-

1: Up Trend,

- (

Long - Plotted as Green in the following Diagrams)

2: Natural Rally,

- (Close position and stay with Cash)

3: Secondary Rally,

- (Close position and stay with Cash)

4: Down Trend,

- (

Short - Plotted as Red in the following Diagrams)

5: Natural Reaction,

- (Close position and stay with Cash)

6: Secondary Reaction.

- (Close position and stay with Cash)

In his example, Jesse Livermore use 5 points as the filter threshold for stock that go from 30 plus to 100. To make it able to use of all price range of stock, using "percentage change" would be a good choice for programming the algorithm. And, in fact, this is the ONLY parameter that needs to be taken care of...

Parameters Setting:

All the following charts are using the same setting of 10% as filtering threshold. Of course, one can go through computerized optimization to find out what value work best, over here it is just for illustration purpose.

The next three charts below are S&P500 Monthly, Weekly and Daily Chart. And are all have the Livermore Market Key with 10% threshold setting:-

SPY (S&P500) Monthly Chart: Click to enlarge

SPY (S&P500) Weekly Chart: Click the Chart to enlarge

SPY (S&P500) Daily Chart: Click the Chart to enlarge

It shows that there are more Buy and Short Signals from shorter time-frame chart, that's the daily chart. (But, the back test data show that the Monthly Chart actually gain more profits.)

The following are just some charts around the globe with this indicator:-

China SSE Composite Daily Chart: Click to enlarge:

Singapore Straits Time Index Daily Chart: Click to enlarge

UK ETF Daily Chart: Click to enlarge

Germany ETF Daily Chart: Click the Chart to enlarge

Note: The back tested data has shown a surprising fact: That's this algorithm work better in longer time frame... That is trading with weekly charts are more profitable than daily charts.

The Algorithm that describes in his book, "How to Trade in Stock" is now decoded in the form of programming flow-charts, and it can be download here.:->

Programming the Jesse Livermore Market Key

Jesse Livermore once said:

"It was never my thinking that made me money but my sitting tight."

How True! People would normally think too much either win or lose in their account with the emotion of greed or fear. Only those who work with system and stick with it can sit tight.

"...providing tools that can be utilized to evaluate information is more important than providing information; that tools whereby one can use his/her judgment is more important than providing values, and demanding responsibility is more important than providing laws and rules of conduct. The latter should be the default of only those who are unable or unwilling to take responsibility." - Clara Szalai (Philosopher, Writer)

The program source code in AFL can be download from:

2) Amibroker's AFL Library.(Need some little work to re-define the plotting state.)

---------------------------- Additinal note added on 10 May 2012 -------------------------------------

Like most other single stock indicator, Livermore Market Key was designed to analysis single stock. In his book, Livermore put recommend to put two similar stocks(same sector) next to each other as to it would help to confirm the signals.

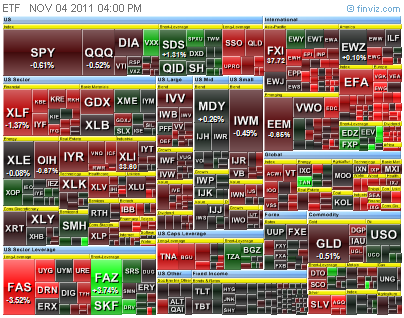

As of today, the market is much more complex. It is recommend to have a overall view on the market with the concept of

-> Sector Rotation <- rather than just focus in one stock.

---------------------------- Additional note added on 19 Apr 2013 -------------------------------------

Just thought of an idea.

Instead of plotting the levels indicator, one can actually plot these level lines ONTO the price chart itself. The advantage would be knowing in advance the exact stop level instead of waiting for the indicator to switch states.

Would get back to work on this soon.

---------------------------- Additional note added on 06 May 2013 -------------------------------------

As promised on the last update, the following linked shows the Livermore Secret Market Key's Levels plotted on the price chart itself. Very much helpful in visualizing the market action taking place and how the Market Key works!

Livermore Secret Market Key on Price Chart

---------------------------- Additional note added on 29 Sep 2013 -------------------------------------

When the Livermore Market Key fires the signals, it is the time when the Dow Theory three movements are in the same direction...

http://blessedfool.blogspot.sg/2013/09/project-freedom-13-multiple-time-frame.html

------------------ Additional Information Added on 06 Jan 2015 -----------------------

Excerpt from the book -

Jesse Livermore's Methods of Trading in Stocks - written by Richard D. Wyckoff

//--------------------------------------------------------------------------------------------------//

HIS OFFICE EQUIPMENT

He arrives at his office ,which is on one of the upper floors of a big down town skyscraper. There is no name on the door. It consists of a reception room,private offices for some of his assistants. and his own private office,separated by swinging doors from his board.room. This is an oblong room with a long silicate quotation board on one side and a row of windows opposite. On the board are exhibited quotations for thirty or forty of the leading active stocks, and a few each of the active futures in cotton, wheat, corn and oats. The quotation board is not arranged according to the ordinary custom prevailing in brokerage houses. The changes in quotations are not posted by means of printed tickets containing merely the opening, high, low and last figures; instead , each stock has its own column running the full length of the board. in which the various changes in quotations are written with chalk, with the numerous sales strung along down below the abbreviations. He prefers this kind of board because it gives him a line on the swings of a stock, the extent of its rallies and reactions, as well as its relative activity.

The volume of trading does not appear on the board; he gets this from the tape.

(Also in the the book - there is a concise chapter on Tape Reading)

Chapter 4. How Livermore Reads The Tape

How He Judges The Turning Points

How He Plays The Intermediate Swings

//---------------------------------------------------------------------------------------------------//

For those who are interested in Livermore methodology, you probably had read the book -

Reminiscences of a stock operator written by

Edwin Lefevre. (PDF version is easily available by online search.)

Just the first few pages, it disclosed the method that brought him into the stock market as a child. What is it??? --> TAPE READING!

In Short, the Jesse Livermore Secret Market Key is NOT COMPLETE without integration of the trading volume from

Tape Reading.

Enjoy. :-)

Bless You

KH Tang

HOME

.jpg)