Follow The Money: When China Stimulates its Economy, Buy Coal!

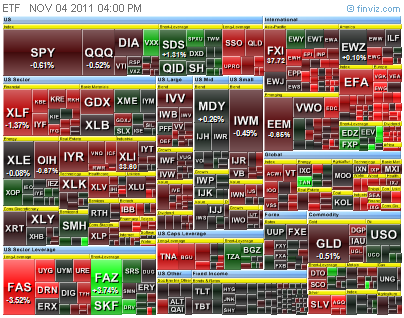

The above illustration

shows the XinHua China 25 index, the Global Coal ETF Charts, and their

correlation.

As China is the world

Largest Coal Consumer, when they stimulate their economy they need more energy

for their power plants, more material to built infrastructures and consumer

products, therefore the demand for coal would increase.

The above chart shows

the Result a year after the stimulation.

Though the XinHua China 25 index rose for 85%, there were many other

sectors/countries performed much better than that.

The Top Ranking was KOL

(Global Coal ETF), follow by Metal, China Real Estate and other related

material producing countries.

YES… These are History.

Is there anything that

we can learn from it???

Of course!!!

Now… Let’s look at these news:

(The analyst from China said that the government will invest more than 1000 Billion RMB to strengthen their infrastruture to simulate the economy)

2. 万亿项目获批股市“一阳指”

(China market bounds up on the news on new stimulation plan approval)

3. China approves US$158b in infrastructure

Yes. The history will repeat itself to high degree (provided there is no major war and natural disaster).

Notes:

1) This is similar worldwide... It follows the Pareto Principle, since the recorded history, that 80% of the wealth belongs to the 20% of the people (these numbers are just getting bigger in spread - 90% vs 10% or worst). The more money the governments pour into their economy would only benefits to the minority who know how to get it. Normal working class would normally working harder to keep their job, and therefore miss the opportunities and suffer from the aftermath through inflation.

2) Even though the world economy is in deep trouble, and it will reveal the trouble later at a bigger scale when there is not way to cover up. But, at the moment, these stimulus could help to prolong the grow before the final collapse. Just like giving another heavy dose of drug to keep the already exhausted sport man to continue the game...

Therefore, timing it with charting for proper entries and exits to ride the trend is important, never argue with the mass psychology that forms Mr. Market with logic using the conscious mind.

<Home>

(China market bounds up on the news on new stimulation plan approval)

3. China approves US$158b in infrastructure

Yes. The history will repeat itself to high degree (provided there is no major war and natural disaster).

Notes:

1) This is similar worldwide... It follows the Pareto Principle, since the recorded history, that 80% of the wealth belongs to the 20% of the people (these numbers are just getting bigger in spread - 90% vs 10% or worst). The more money the governments pour into their economy would only benefits to the minority who know how to get it. Normal working class would normally working harder to keep their job, and therefore miss the opportunities and suffer from the aftermath through inflation.

2) Even though the world economy is in deep trouble, and it will reveal the trouble later at a bigger scale when there is not way to cover up. But, at the moment, these stimulus could help to prolong the grow before the final collapse. Just like giving another heavy dose of drug to keep the already exhausted sport man to continue the game...

Therefore, timing it with charting for proper entries and exits to ride the trend is important, never argue with the mass psychology that forms Mr. Market with logic using the conscious mind.

"A speculator must concern himself with making money out

of the market and not with insisting that the tape must

agree with him. Never argue with it or ask for

reasons or explanations."

- Jesse Livermore

<Home>

.jpg)