.

The above slide shows the concept of correlation formula of two set of data. In application wise, it can use for pattern recognition. Such as image or voice recognition, etc.

In his latest book, "Cycle Analytics for Traders", John F. Ehlers even uses it to calculate the dominant cycle in the stock chart.

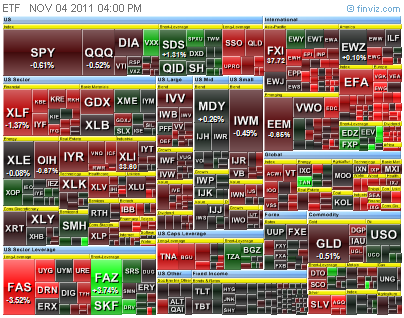

So, in broad term, Correlation can be used to find the similar patterns in stock market charts.

There are various usages:

* Such as using one index or ticker to confirm another - like Dow Jones Transport Index to confirm the bull or bear state of Dow Jones Industrial Average in the past (may be not so valuable now as internet age taken over, and many software products can be download online.)

* Find some current patterns that highly correlated with historical patterns, and use it for prediction that it will follow through in the short future. - Such as head and shoulders, scourers, etc.

* Correlation of season in the year for commodity trading, etc...

* And, correlation would work for even more complex type of waveform, as it can use as the engine for image recognition algorithm... And, here comes the story...

Well, I suddenly think of posting this article because, just a moment ago, I come across another article - "SCARY PARALLEL" that could be of high interest to others and would like to see how it develops over the next few months.

The link of the original article is Here "Scary 1929 market chart gains traction".

From the chart patterns, though I don't have the access to the raw data to compute the correlation value, but experience would tell me that the correlation value would surely be higher than 0.8. So, in theory wise, it has the Prediction Value until Proven Wrong!

On the other hand, when applying this concept...

This short video clip is an excellent example of illustrating the concept of pattern recognition - One can only confirm the actual answer after thing happen.

Will come back here in 2 months time to see the outcome. :-)

Bless you

KH Tang

(HOME)

.jpg)

1 Comments->:

Wow! It is an informative and fundamental website about financial markets. It is very useful for us. So, I loved it. Many, many thanks to you for creating such an informative website. If you would like more information about this please visit stock market watch The advantage of these stock market watch is they allow for a vast amount of customization by the user. That same advantage can create a disadvantage for some users. Those users may not really know what they are looking for or what data criteria might produce a stock market watch of stocks that present the highest possible probability of a successful stock trade.

Post a Comment