Jesse Livermore (July 26, 1877 – November 28, 1940) is one of the

most famous legendary traders in stock market.

His intriguing hero’s journey in the Wall Street was well recorded in the

book – “Reminiscences of a Stock Operator” by American author Edwin

Lefèvre. And, this book is widely quoted

in many trading books and recommended in many trading classes.

But, not many people know about his “Livermore

Secret Market Key” which was written by himself and published in 1940. This book can now being found in Wikipedia Link

for free download.

Jesse Livermore spent up to 40% of his book in explaining the technical details of his operation in the stock market. The challenge is for the reader to understand and implement it.

Unfortunately, it is not a simple task to understand the method in table form. For there was no programming flow-chart during his time, he used a table and long procedures to go through how to fill it up. Most beginners will lost his way in their first few attempts.

The objective of this article is to demonstrate that the 6-columns table can be programmed into 6-levels of band in modern price chart, and it would faciliate the readers to visualize the interaction of Jesse Livermore Secret Key and the stocks.

Fig 1. Transformation of Livermore Secret Market Key from Table to Price Chart.

Fig 2. The Livermore Secret Market Key in Action.

One of the famous quote from Jesse Liver more is:

"Wall Street never changes, the pockets change, the suckers change, the stocks change, but

Wall Street never changes, because human nature never changes".

So, What do you think? IF he is still around today and using the same method, written 70+ years ago, can he still make money?

The following are various charts using Livermore Secret Market Key and they clearly demonstrate that he is right. For this method is advocating Trend Trading and ignore minor noise (which means do not run in and out of a stock too frequently).

A Minor Change in the Rule:

During his time, Jesse Livermore used fixed amount of dollar to define the "Levels of Band" as filter, similar to

Point and Figure charting method using 3 point change. But as of today, there are stocks trade more than hundreds or thousands of dollar, so two types of changes can be applied to the original method to see the effect. The first change in the method is, logically, using the fixed percentage change, and second, using the fixed amount of Average True Range(ATR) for the band's level.

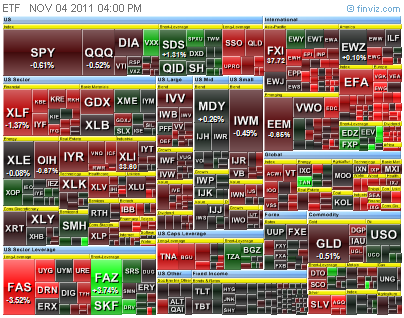

Fig 3. Livermoare Secret Market Key applied on SnP500 ETF(SPY) (Weekly)

In Figure 3, the upper chart shows the "Fix Percent Band" while the lower chart shows the "ATR Band".

Fig 4. Livermoare Secret Market Key applied on SnP Financial Sector ETF(SPY) (Weekly)

There are two points to be made in Figure 4 (Click and Zoom In).

1) It is Crystal Clear that if one were to follow the weekly chart religiously, he will not suffer from the 2008 financial crisis. For the chart shows a clear down trend.

2) Using "ATR Method" is superior than "Fix Percentage Method", for every stock/commodity/ETF has its own characteristics in terms of Volatility. Using ATR method help to adjust the band-level automatically for all vehicles.

So, from here on, the following charts will ONLY use ATR band (Dynamic Band that self-adjust to the stock volatility) as demonstration.

Fig 5. Some Hot stocks - Apple and Google (Weekly).

Yes. Due to whatever reason, even till today, there are still people using "

Buy and Hold" method in the market. From the above Chart, there are two points we can learn:

1) IF the Goal is to make profit from the market, follows the trend. NEVER EVER ARGUE with the price chart. IF the Goal is to PROVE he is right that the stock will eventually go up again some time in the future while the chart moving down, by all means, let him hold on as long as he like.

2) IF the market is on side-way, using Trend Trading Method would incur in lost, therefore, one need to learn to learn the master the skill of

CUTTING LOST. It would be so much better to acknowledge that was only a small error made in the market rather than let it continue to grow and eventually becomes a BIG MISTAKE.

The following are more charts to illustrate the points mentioned above.

Fig 6. Commodity - Silver and Gold ETFs (Weekly)

.

.

Fig 7. Commodity - Argriculture and Commodity Index (Weekly)

NOTE: If Argiculture commodity is moving down or in a side way, chances that those related companies are not performing too, even if whatever fundamental data of the stock are strong. Use the money to invest someway else, and wait untill the relevant commodity to move up, then buy the related stocks.

.

Fig 8. Malaysia KLSE Index and Singapore STI (Weekly)

..

..

Fig 9. Hong Kong HSI and Japan Nikkei 225 Index (Weekly)

.

.

It is very interesting to note that Malaysia market has performed so much better among her few Aisa peers since the 2008 global finacial crisis. My guess is that the DID NOT lose so much money in that crisis in the US Banks as compare to the others. :-)

"There are many times when I have been completely in cash, especially when I was unsure of the direction of the

market and waiting for a confirmation

of the next move...."

Jesse Livermore

------------------ Additional Information Added on 11 Aug 2014 -----------------------

//--------------------------------------------------------------------------------------------------//

HIS OFFICE EQUIPMENT

He arrives at his office ,which is on one of the upper floors of a big down town skyscraper. There is no name on the door. It consists of a reception room,private offices for some of his assistants. and his own private office,separated by swinging doors from his board.room. This is an oblong room with a long silicate quotation board on one side and a row of windows opposite. On the board are exhibited quotations for thirty or forty of the leading active stocks, and a few each of the active futures in cotton, wheat, corn and oats. The quotation board is not arranged according to the ordinary custom prevailing in brokerage houses. The changes in quotations are not posted by means of printed tickets containing merely the opening, high, low and last figures; instead , each stock has its own column running the full length of the board. in which the various changes in quotations are written with chalk, with the numerous sales strung along down below the abbreviations. He prefers this kind of board because it gives him a line on the swings of a stock, the extent of its rallies and reactions, as well as its relative activity. The volume of trading does not appear on the board; he gets this from the tape.

(Also in the the book - there is a concise chapter on Tape Reading)

Chapter 4. How Livermore Reads The Tape

How He Judges The Turning Points

How He Plays The Intermediate Swings

//---------------------------------------------------------------------------------------------------//

In Short, the Jesse Livermore Secret Market Key is NOT COMPLETE without integration of the trading volume from Tape Reading.

----------------- Additional Information Added on 25 Sep 2014 ----------------------------

From Investopedia:

"Dark Pools - Dark pools are an ominous-sounding term for private exchanges or forums for trading securities; "

"The current controversy surrounding dark pools may lead one to think that they are a recent innovation, but they have actually been around since the late 1980s. Non-exchange trading in the U.S. has surged in recent years, accounting for about 40% of all U.S. stock trades in 2014 compared with 16% six years ago. Dark pools have been at the forefront of this trend towards off-exchange trading, accounting for 15% of U.S. volume as of 2014, according to figures given by industry insiders."

.jpg)