There are many famous Gurus in the financial market, and their philosophies are pretty well accepted by their followers (subscribers).

Take for examples:

1. Jim Rogers is the icon represents long term investment in the commodities market.

2

2. Marc Faber, also known as Dr. Doom, advocates that the market is collapsing, collapsing, and collapsing...

3.

3. Stephen Leeb is using the "Peak Oil" as a backgroud and focus on Energy Sector.

4.

4. Peter Schiff is singing about the collapsing US Dollar and Accumulates physical gold or GLD (ETFs).

.

And, when they are correct, they will occupy everywhere in the media and get more followers.

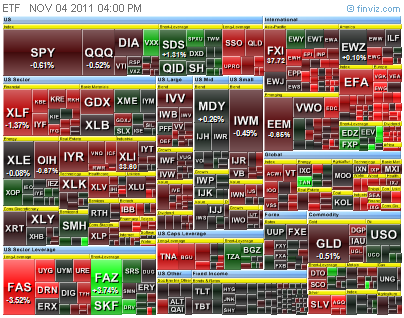

Now... As shown in the charts, they were ALL CORRECT at certain point of time in a "Rotational Manner".

So... Don't you think that having a "market neutral mentality", doing your study, understand and follow the market actions with the charts, and perform asset class rotation is a better deal?

Now...

See what the successful Trader and Trainer in the Stock Market, Richard D. Wyckoff, had to say:

<Go to Home>

Take for examples:

1. Jim Rogers is the icon represents long term investment in the commodities market.

2

2. Marc Faber, also known as Dr. Doom, advocates that the market is collapsing, collapsing, and collapsing...

3.

3. Stephen Leeb is using the "Peak Oil" as a backgroud and focus on Energy Sector.

4.

4. Peter Schiff is singing about the collapsing US Dollar and Accumulates physical gold or GLD (ETFs).

.

And, when they are correct, they will occupy everywhere in the media and get more followers.

Now... As shown in the charts, they were ALL CORRECT at certain point of time in a "Rotational Manner".

So... Don't you think that having a "market neutral mentality", doing your study, understand and follow the market actions with the charts, and perform asset class rotation is a better deal?

Now...

See what the successful Trader and Trainer in the Stock Market, Richard D. Wyckoff, had to say:

Very true! In my view, most of the publication on financial advices and news are just

like Coke or genetic modified foods. They are

are produced for the public consumption with the intention of making a profits out of it. The earlier one chooses to stop taking them, the

earlier he gets healthier.

In a Nutshell : Why Market Rotation?

The stock market, as of today, is working like a Giant Ponzi Scheme as a Whole, which is formed by Multiple Smaller Ponzi Schemes as Sectors, Countries and Individual Stocks. The Public Media would help to Rotate in Bubbling few Sectors/Countries//Stocks at a time for profiteering and dump the shares to the public, let them burst, and then ROTATE the operation to Other Sectors/Stocks.

The stock market, as of today, is working like a Giant Ponzi Scheme as a Whole, which is formed by Multiple Smaller Ponzi Schemes as Sectors, Countries and Individual Stocks. The Public Media would help to Rotate in Bubbling few Sectors/Countries//Stocks at a time for profiteering and dump the shares to the public, let them burst, and then ROTATE the operation to Other Sectors/Stocks.

"What information consumes is rather obvious:

it consumes the attention of the recipents.

Hence a wealth of information creates

a poverty of attention."

- Herbert Simon

<Go to Home>

<Comments>

.jpg)

8 Comments->:

Hi,

Your blog is very informative; and you share very good info with us, it’s very useful for every trader and investor especially intraday investors. Today Nifty is trading on a positive note, so any figure can you give about today's closing level. It would be really appreciated.

Regards,

Trading Tips

Good day,

Just to clarify that this blog is not advocating intraday trading nor accepting any trading tips. Rather, it's intention is to inspire the public to invest time in learning how to handle their personal finance matter.

Bless You

KH Tang

Thanks for the information, I've been researching personal finance online in order to plan for my retirement. I've had a few people suggest that I sell my structured settlement and invest the money, but I'm not sure if that is the best strategy.

Good day, James Reynolds

I AM not a financial advisor. And, since you ask, I give my opinion.

I did come across those advertisement on "sell your structured settlement" some time ago. My gut feeling tells me that this is going to create more financial problem for the individual and the society in the future.

Let me explain... the public would choose this path most likely need some urgent money. And, the fact is that 90-95% of the trading/ investment accounts lost money in long run. So, by cashing out the money now and invest yourself, the probability of winning is very low. These money mostly will ended up in those composite operator eventually. Unless, you have spent years ahead prepared yourself for it, and has good record of winning over a period of time.

Also, I search the web and find this better answer for you. :-)

http://www.oprah.com/money/Advice-for-Cashing-Out-a-Structured-Settlement-Suze-Orman-Financial

Bless You

KH Tang

I think all of us know the Monster beats pro, it is very good with high performance, and the best quality.

The best personal finance tip I could provide you with is to stay within your indicates. But because this is a very apparent tip, I’d like to provide you another: deal with your health and health and fitness and health and health and fitness and health and fitness. It may not seem like a individual fund tip, but your health and health and fitness and health and health and fitness and health and fitness has so much to do with your cost-effective well being.

This INFORMATION is so nice so sweet,

Sell your art work

Post a Comment