Attached are a few charts aim to demonstrate the importance of understanding the State of Market Trend and the Rotational Trading Concept which could help one to handle his personal finance.

POINT I: Understanding of the States of Market Trend.

Fig 1. ^STI Daily Chart (2 years) (Click on the chart to Zoom in)

Over the two years period, when breakdown into percentage...

The UPTREND is : 31.39%;

The DOWNTEND is : 18.05%;

The SIDE WAY is : 50.56%.

As the previous point illustrate that money put in one market/Stock/Fund are really productive about 30% of the time in UPTREND, 20% in DOWNTREND, and wasting time 50% of the time.

So, if one were to only LONG the market, does that mean 70% of the time he must wait???

Not true if he understand the concept of Sector Rational Trading.

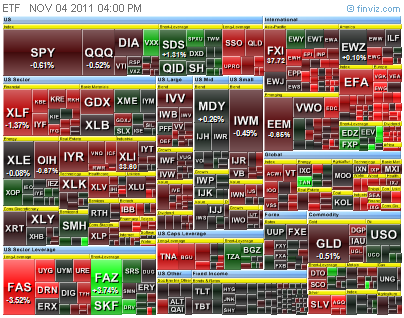

Fig 3. State of Trends in S&P500(SPY)

and its 9 sectors(XLB,XLE,XLF,XLI,XLK,XLP,XLV,XLU,XLY) (Apr 2010 to Apr 2012)

See...

The money in the market are of fix amount. When the stock market is moving up strongly, people would pull money out of bond market and put into stocks and cause bond market to fall, and vice versa. Similarly, the professionals would not put their funds in equal distribution into all sectors, they would pull the money out from the weak sectors to put them into the strong sectors. And the sectors Relative Strength would keep changing over time. In the picture, you can see the TREND is Out Of Phase from one another.

With the same token, one can then zoom into the individual stocks, in the strongest sector, to ride on the trend with the few strongest stocks

By the way, you may be interested to zoom into the chart and see the respective percentage of trends in various sectors.

Conclusions from Piont II:

1) It illustrates a VERY IMPORTANT POINT that is IN CONTRADICTION with one of the popluar myth in the investment industry --> That is DIVERSIFICATION the money into many sectors in equal portions as to reduce RISK. As sectors trend pretty much follows the market (after all they are the components that create the market).

2) In order to maximize the profit from the market and reduce risk. One must always rotate money into the strongest few sectors when there is a trend.

---------------------------------------------------------------------------------------------------------------------

I found a picture on the web and it is Very True.

A more throughout explaination on Sector Roation -> Back to Basics & The Galaxy Chart.

POINT I: Understanding of the States of Market Trend.

Fig 1. ^STI Daily Chart (2 years) (Click on the chart to Zoom in)

The above chart show a daily chart for ^STI from Apr 2010 to Apr 2012. This particular period is selected to show that money put in the market (so call buy and hold investment) can ended up with zero percent return over years.

In the price chart, there are algorithms built-in to draw the trendlines (also act as dynamic support and resistance lines). When the bar change color, it signal a possibility of change in trend.

In the lowest pane, it is an indicator desgined specifically to measure the Vibrational Energy of the stock:

If the Energy is High and moving upwards, it signals a state of UPTREND MARKET.

If the Energy is High and moving downwards, it signals a state of DOWNTREND MARKET.

If the Energy is Low, it signal a state of SIDE WAY MARKET.

It also display the number of bars in the respective state of trend and its percentage over the period. For example:

Over the two years period, when breakdown into percentage...

The UPTREND is : 31.39%;

The DOWNTEND is : 18.05%;

The SIDE WAY is : 50.56%.

So, one may think that two years of data could be too short to make the point. How about longer period of data?

So, with the longer term of data, it show that the result is similar with the previous finding. And, lead to some basic understanding of the market trends structure...

Conclusions from Point I:

1) The Speed of UPTREND is SLOWER and DOWNTREND is FASTER.

2) BUY AND HOLD strategy is NOT WORKING in todays market.

3) One must be able to ride on the Trend in order to make profits from the market.

POINT II: Understanding of the Sector Rotational Trading Concept.1) The Speed of UPTREND is SLOWER and DOWNTREND is FASTER.

2) BUY AND HOLD strategy is NOT WORKING in todays market.

3) One must be able to ride on the Trend in order to make profits from the market.

As the previous point illustrate that money put in one market/Stock/Fund are really productive about 30% of the time in UPTREND, 20% in DOWNTREND, and wasting time 50% of the time.

So, if one were to only LONG the market, does that mean 70% of the time he must wait???

Not true if he understand the concept of Sector Rational Trading.

Fig 3. State of Trends in S&P500(SPY)

and its 9 sectors(XLB,XLE,XLF,XLI,XLK,XLP,XLV,XLU,XLY) (Apr 2010 to Apr 2012)

See...

The money in the market are of fix amount. When the stock market is moving up strongly, people would pull money out of bond market and put into stocks and cause bond market to fall, and vice versa. Similarly, the professionals would not put their funds in equal distribution into all sectors, they would pull the money out from the weak sectors to put them into the strong sectors. And the sectors Relative Strength would keep changing over time. In the picture, you can see the TREND is Out Of Phase from one another.

With the same token, one can then zoom into the individual stocks, in the strongest sector, to ride on the trend with the few strongest stocks

By the way, you may be interested to zoom into the chart and see the respective percentage of trends in various sectors.

Conclusions from Piont II:

1) It illustrates a VERY IMPORTANT POINT that is IN CONTRADICTION with one of the popluar myth in the investment industry --> That is DIVERSIFICATION the money into many sectors in equal portions as to reduce RISK. As sectors trend pretty much follows the market (after all they are the components that create the market).

2) In order to maximize the profit from the market and reduce risk. One must always rotate money into the strongest few sectors when there is a trend.

---------------------------------------------------------------------------------------------------------------------

I found a picture on the web and it is Very True.

Bless You

KH TangA more throughout explaination on Sector Roation -> Back to Basics & The Galaxy Chart.

.jpg)

.jpg)

.jpg)