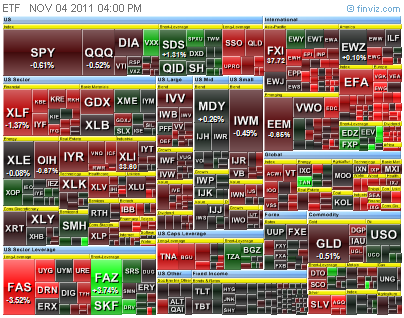

In this Feburary issue of the "Smart Money" magazine, it takes a look at the America's Top 1% fund managers and find out how big is the profits from this business -- that is Making Money from the Market.

In this Feburary issue of the "Smart Money" magazine, it takes a look at the America's Top 1% fund managers and find out how big is the profits from this business -- that is Making Money from the Market.It reveals that recently most mutual funds have been under attack for being under-performed their benchmarks (indices). And, ONLY 7% of actively managed funds were beating their benchmarks by 5% point or more.

And, it gives statistics on the average annual return for the past 5 years for the Top Performers in various area of focus:

*Foreign Stock funds,*U.S. Large Cap Funds,*Global Real Estate Funds, and

*U.S. Small Cap Fund.

Unlike the advertisement that trying to lure the public into the stock market by selling few days seminar that can double your money in a year or two. It may be surprise to some of you that the average annual return (5 yrs) of these Top Performing Funds from various fields range only from 2.2 to 13.8%!!!

Having read this, I thought it would be an interesting research to find out how the world most well known investor, Warren Buffett, was doing recently. And, what conclusions we may derive from it.

The above are two charts showing the 20 years performance of the S&P500 and the Warren's Berkshire Hathaway(BRK-A). And below is an excel sheet showing the historical Average Annual Compounded Return for the chars. (click on those charts and table to zoom in for clear view.)

The above are two charts showing the 20 years performance of the S&P500 and the Warren's Berkshire Hathaway(BRK-A). And below is an excel sheet showing the historical Average Annual Compounded Return for the chars. (click on those charts and table to zoom in for clear view.) From the table above, it show the comparison of the historical compunded average return of S&P500 and BRK-A. The table below shows the summary of the result.

From the table above, it show the comparison of the historical compunded average return of S&P500 and BRK-A. The table below shows the summary of the result.

Here are some interesting points to observe:

* Like most business in the any industries, the business of making money from the market is getting tougher and tougher! Well, this is simply the fact. As the business in the industries is getting more and more difficult, more companies could go bankrupt or downsize. This would directly reflect from the S&P500 chart.

* Even the best fund manager like Warren Buffet can just beat the S&P500 in single digit percentage over the years.

* Despite the massive money supply created by the governments for the last couple of years, the stock market did not really seems to move up in trend, only the inflation moving up in trend, and apparently annual inflation of food is going up much faster than what the best fund manager can achieve... What would Happen!?

The intention of this blog entry is wish to project a realistic view for those who think to get out from the job immediately and trade the market for a living from scratch. Despite the steep learning curve that would last a couple of years, one must have million dollars to make 100k on annual basis even if he got the skill.

On the other hand, if one were to think of handling their money by themselves, due to too many scams in the financial industry in recent years, after their retirement. It is strongly recommended to start learning the skills at least 10 years before the actual date of retirement... and that is probably the minimum amount of time required on part-time basis. Dig your own well before you are thirsty.

Demonstrating to others that what they believe is wrong can be dangerous.

You can't count on people to recognize the truth when they hear it.

People will fight to preserve their own ignorance.

- lessons from Plato

You can't count on people to recognize the truth when they hear it.

People will fight to preserve their own ignorance.

- lessons from Plato

.jpg)

0 Comments->:

Post a Comment