As human perspective tends to focus on the short term events and, to most people, retirement seems to be something that is very far away. As the time keep passing by... and when it come close to their "official age" of retirement, most will get a shock that they are not ready for it.

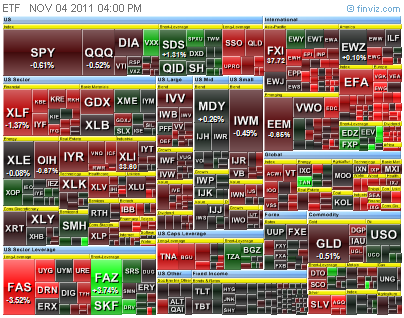

Click to Zoom In

Another reason for people to ignore the retirement fund issue is as what Dr. Albert A. Bartlett had said:"The Greatest Shortcoming of the Human Race is our Inability to Understand The Exponential Function." That is most people cannot easily imagine in their mind that how big the number would get into with the compound inflation rate (and it now climbing proportional to the rate of Money Supply.)

To over come this challenge, here is a tool, Excel Worksheets, that was designed to help in putting all these figures down on paper. It can help individual to figure out how much it would require for him/her to be financial independent/freedom at a target date.

In the worksheet 1: just need to fill in the following data:

In the worksheet 2: one would need to fill in the details of expenses in various categories into the various fields as circled in the following diagram. It will then compute the ultimate retirement found figures with compound interest/inflation rate.

In the worksheet 3: Well, lot of people like to buy lottery and hope to retire now. This worksheet will tell you EXACTLY HOW MUCH you need to set the figure for achieving your goal -- that is the amount of money that you need to have in order to retire immediately. :-)

When someone is prepared early, this will not be his scenario:-

Here is link for the downloadable Tool in Scribd:->

Personal Finanical Tool:Retirement Fund Calculation

By the way, just some points for ponder....

* Why is there an "Official Retirement Age", and why many people follow? Are you plan to follow this "rule"?

* If making enough money can retire early, why many politicians and businessmen do not retire early and choose to work till the last day in their life?

"If you continue to think like what you always thought,

you continue to get what you always got."

- ?

.jpg)

0 Comments->:

Post a Comment