Well, just to forward a successful currency trader friend’s opinion(social service) from Australia, as I believe there are values inside for sharing ...

-------------------------------------------------------8<----------------------------------------------------

From: brijon

Sent: Sunday, March 11, 2012 3:29 AM

To: xxx

To: xxx

Subject: japan

brijon 5: GDAY

brijon

5: japans economy is the next finacial buble ready to go into meltdown

brijon

5: this is the next major shock comming to the worlds economic meltdown

brijon

5: a far bigger crises that is being hidden under the table

brijon

5: imports far exceed japans exports now

brijon

5: energy imports oil is massive

brijon

5: there gdp is now one of the worst in the world

brijon

5: on 26th march all neucler plants are beuing shut down

brijon

5: so we are being like always are being kept in the dark about the real

problems unfolding on the world economy

brijon

5:

brijon

5: the carry trade is already in reverse as japans money flow is now

reversed for the carry trade

brijon

5: so the real disaster for finacial markets is starting to unfold

brijon

5: as japan goes into finacial meltdown so all the world wil feel this massive

effect on there economys

brijon

5: my opinion only

-------------------------------------------------------8<----------------------------------------------------It might be a good starting point to do your own research/verification on the points mentioned in the mail, and access the current situation yourself. Or, wait for the public media to give the “Surprise” after the insiders fully positioned themselves. Such as the previous man-made financial crisis.

Such as google for the news:

Of course, most of the people might think that this in not relevant or unimportant to their personal financial matter...

Think again!

The world has been coming up with many man-made economy SURPRISES, one after another, in the last decade. And some surprises wiped up saving and investment in "reliable" banks!

Euro Zone Trouble, US Debt (See US Real Time Debt Clock <-) & Japan energy problems are ready

to have chain-reaction to bring down world economy (just another big Ponzi

Scheme anyway) when something is ignited.

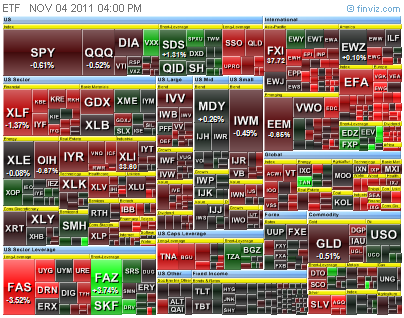

Attached is the DEBT vs GDP ratio and Many in the top list already running into trouble.

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html

Another Source:

http://wallstcheatsheet.com/stocks/the-10-most-indebted-governments-in-the-world.html/

This is NOT crying wolf, as the wolf is already outside the door. Just a matter of timing.

This is NOT crying wolf, as the wolf is already outside the door. Just a matter of timing.

Yes. It is not that easy to find a Inspirational/Positive Quote to end this blog entry...

Anyway, though it is NOT a solution for all, and NOT even a solution for the majority...

Learn to Re-Balance Personal Asset timely in critical time could help to

minimize perosnal financial impact if not profits from it.

.jpg)