Attached video and chart are self-explanatory.

Understand this concept would help traders/investors to insist in using Multiple-Time-Frames when analysing their charts.

(Click to Zoom-in for Full Screen Video)

Dow Theory Three Movements need Multiple-Time-Frame Analysis

.

Understand this concept would help traders/investors to insist in using Multiple-Time-Frames when analysing their charts.

(Click to Zoom-in for Full Screen Video)

Dow Theory Three Movements need Multiple-Time-Frame Analysis

.

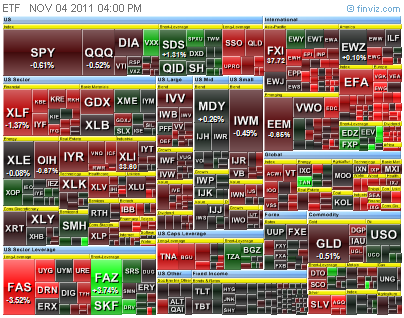

The chart shows that:

1) Stock move the fastest when the three waves move in same direction.

2) Always trade in-sync with the direction of the Primary Wave.

3) Good Entry points with highest Reward/Risk Ratio are when the Primary Trend is UP while shorter terms have came down, Pull-Back Entry.

1) Stock move the fastest when the three waves move in same direction.

2) Always trade in-sync with the direction of the Primary Wave.

3) Good Entry points with highest Reward/Risk Ratio are when the Primary Trend is UP while shorter terms have came down, Pull-Back Entry.

Multiple Time Frames and Sector Rotation Examples: Click on Picture to Zoom In

----------------------------- 7 Sep 2024 -------------------------------

----------------------------- 31 Aug 2024 -------------------------------

----------------------------- 28 Aug 2024 -------------------------------

.jpg)